Income tax Deduction 80TTA | What is Section 80TTA | Interest Income Deduction Under Section 80ttA | Facebook

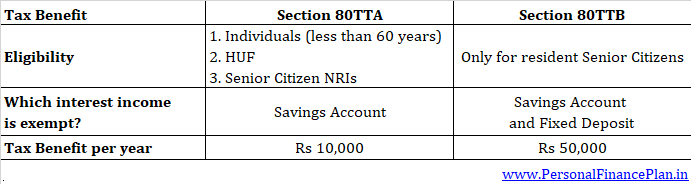

Section 80TTA Tax Benefits - NRI can claim 10,000 INR On interest of Saving Account | NRI Saving and In… | Savings and investment, Investment tips, Savings account

Section 80TTA of Income Tax Act - 2024 | Deduction u/s 80TTA | 80TTA Deduction saving bank interest - YouTube